capital gains tax philippines

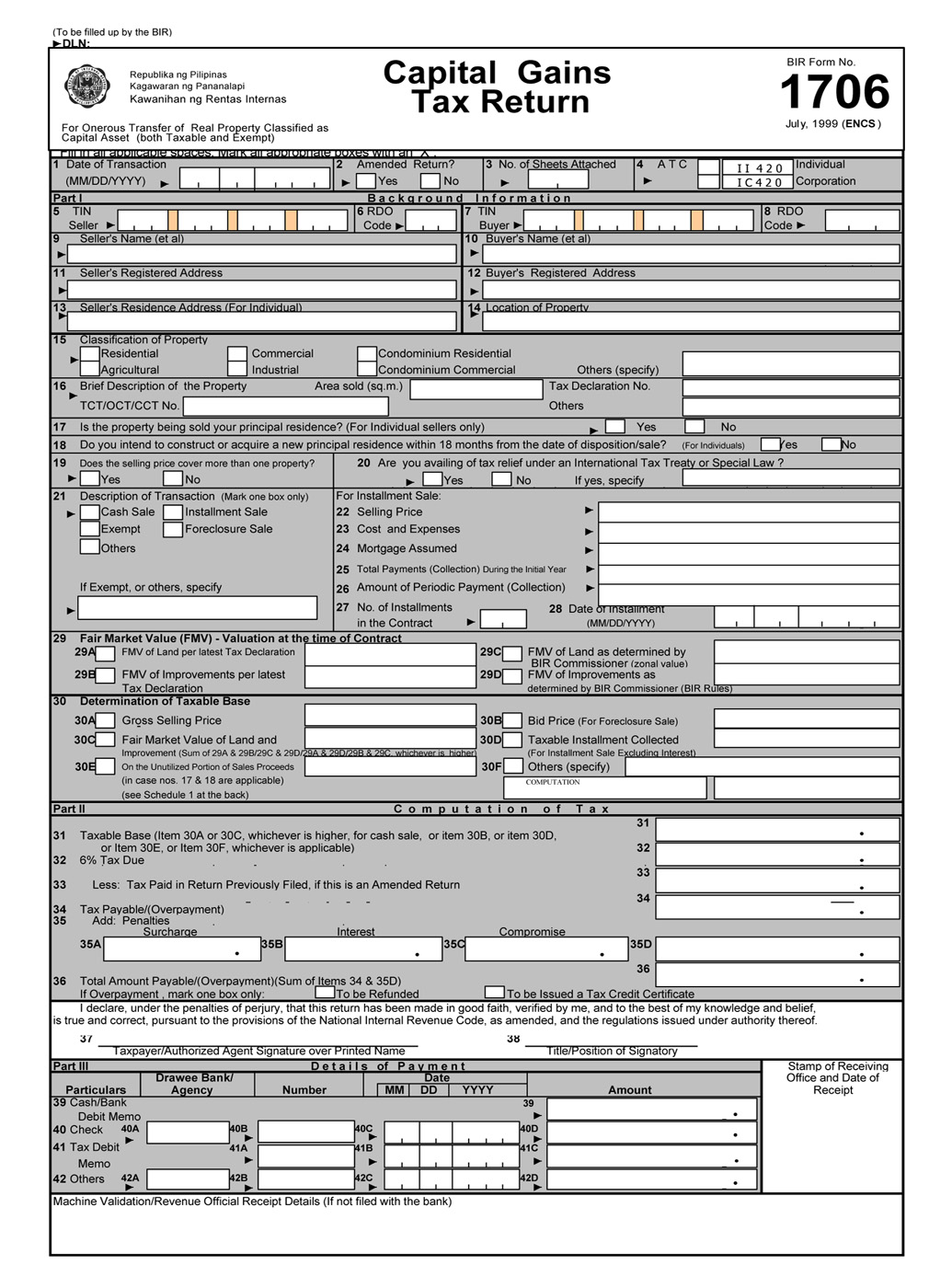

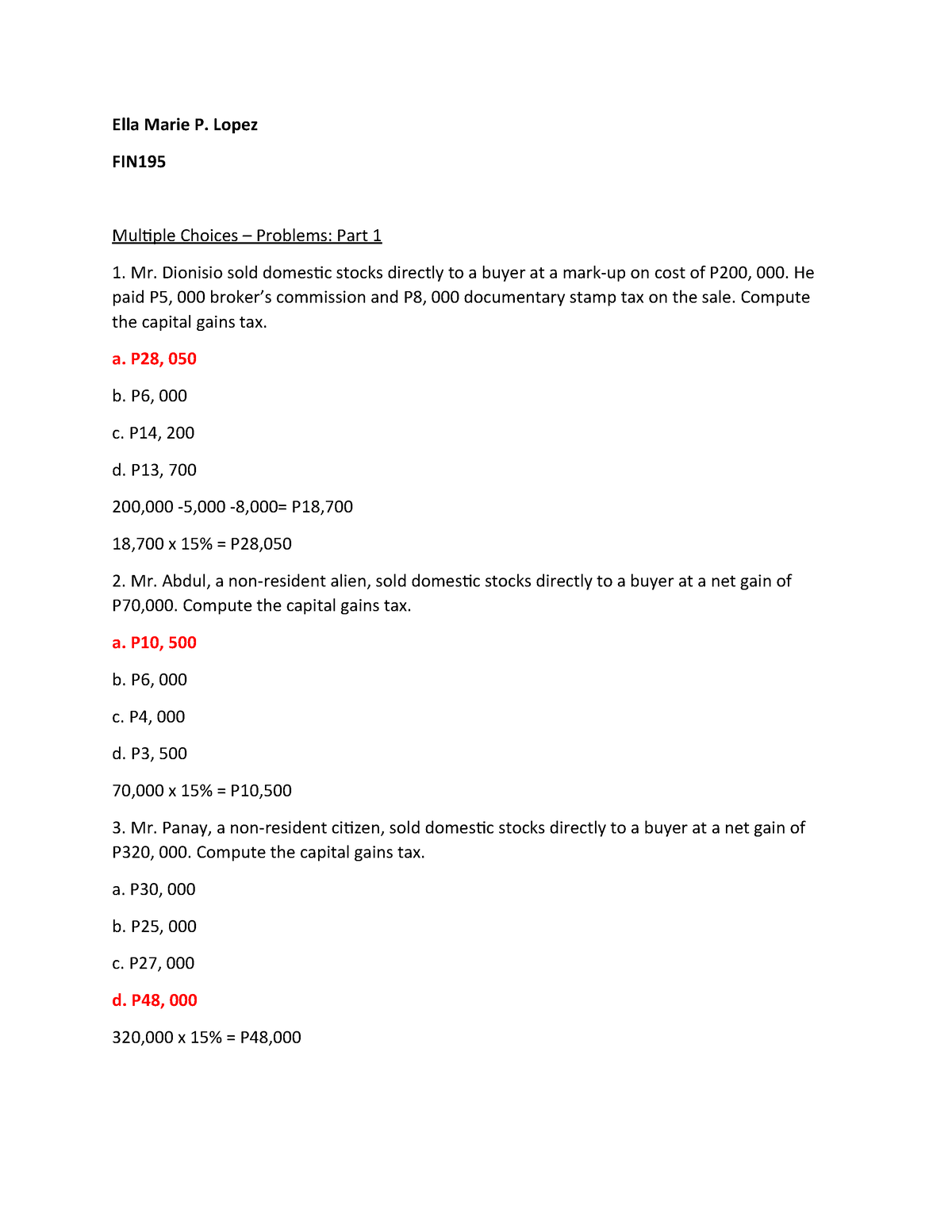

CGT is a tax on the gain from the sale of capital assets. According to the National Bureau of Internal Revenue section 24D the capital gains tax rate is 6 of the propertys selling price.

How Are Dividends Taxed Overview 2021 Tax Rates Examples

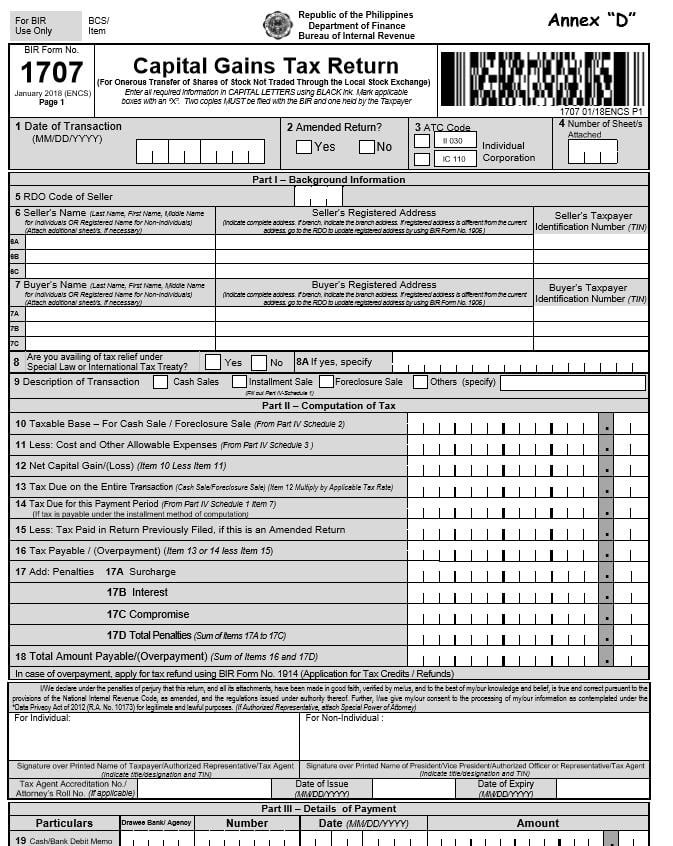

Capital Gains Tax is imposed on gain that the seller gets from a sale exchange or other transfer of capital assets that are located in the Philippines.

. Computing the Estate Tax. Capital gains tax CGT is imposed on both domestic and foreign sellers. In the Philippines there are valid reasons that allow real estate sellers to exempt themselves from the capital gains tax.

Non-compliance will result in a penalty up to PhP 50000 with a 25 surcharge and 20 interest. It is their only source of capital gains in. In usual transactions the selling broker would help the seller pay the 6 Capital Gains Tax for free while the buying broker is not required to do the Title transfer unless the broker buyer made it part of their agreement.

Capital gains tax is one of the obligations property owners need to settle upon selling their property wherein sellers must file a capital gains tax return 30 days after the transaction. Capital positive factors tax on sale of actual property positioned within the Philippines and held as capital asses is predicated on the presumed positive factors. The amount that youll get from this computation will be the estate tax.

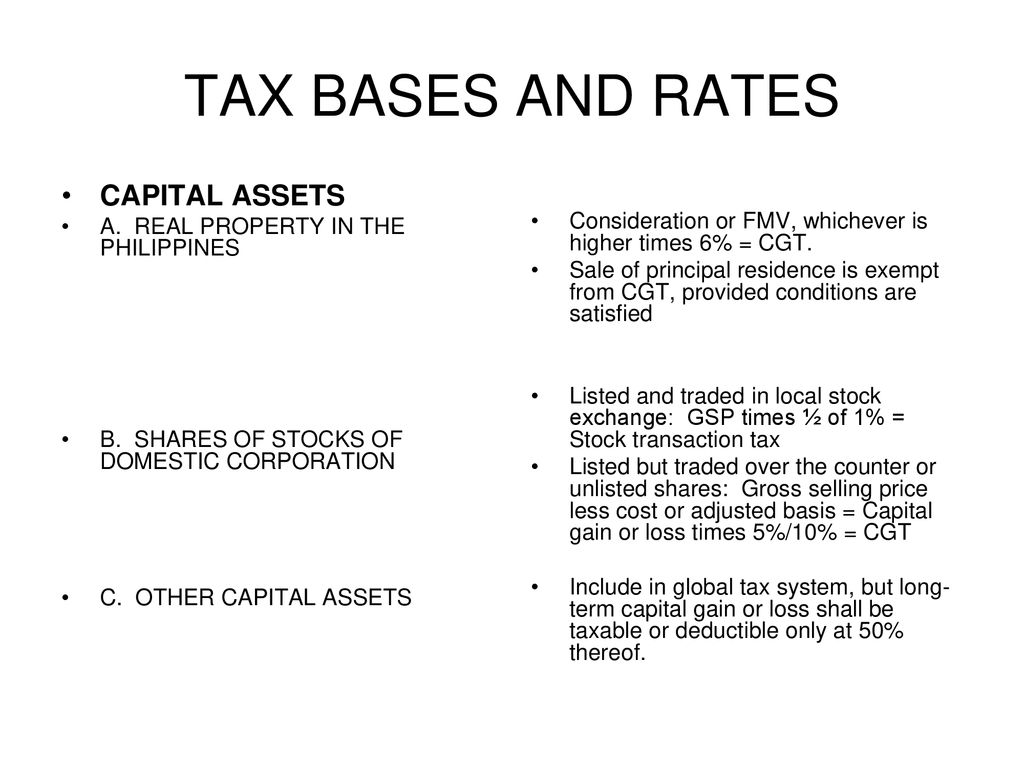

Last reviewed - 30 June 2022. Capital assets are non-income generating properties such as residential real estate. Final Capital Gains Tax for Onerous Transfer of Real Property Classified as Capital Assets Taxable and Exempted.

Its strategic location allowed it to bridge Eastern and Western cultures producing a rich history of Asian European and American influences. Pacto de retro sales and other forms of conditional sales are included in this. To calculate the capital gains tax you check the value of the property or its current fair market value whichever is higher and multiply that by 6.

For example if the property is valued at Php 1000000 you multiply that by 6 and the total. Now that you know the difference between gross estate and net estate its time to compute the estate tax. What is a Capital Asset.

Lt is not the transfer of ownership or possession per se that subjects the saletransferexchange of the 6 capital gains tax but the profit or gain that was presumed to have been realized by the seller by means of said transfer. A 6 Capital Gains Tax is imposed on the presumed gain from the sale of real property located in the Philippines which is classified as a capital asset based on the gross selling price the BIR zonal valuation or the assessed. Capital gains realized from the sale exchange or disposition of shares of stock in any domestic corporation are subject to a final tax rate of 15.

A person is exempted from capital gains tax if the reason for selling their property is to buy or construct a new property. Capital Gains Tax is charged at a flat tax rate of 6 of the gross selling price and must be paid within 30 days after each transaction. 1 In General.

The speed is 6 capital positive factors tax based mostly on the upper quantity between the gross promoting value or truthful market worth. Capital Gains An individual is subject to capital gains tax on the sale of real estate at a rate of 6 of the total selling price or current fair market value whichever is higher. The following capital gains are not subject to a holding period and are subject to special capital gains tax rates.

When there is a sale of real estate automatically people think that they have to pay Capital Gains Tax CGT. The rates are 06 of the gross selling price for shares of stocks listed and traded in the stock exchange. - The provisions of Section 39 B notwithstanding a final tax of six percent 6 based on the gross selling price or current fair market value as determined in 24 accordance with Section 6 E of this Code whichever is higher is hereby imposed upon capital gains presumed to have been realized.

Simply put CGT is. Capital Gains Tax vs. What is Capital Gains Tax in the Philippines.

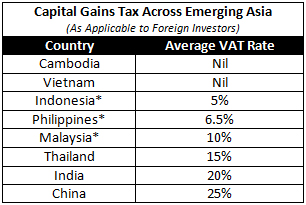

After you get the net estate multiply the resulting amount by 006. And 6 of the higher of the gross sales price or fair market value of real property. In arriving at effective capital gains tax rates the Global Property Guide makes the following assumptions.

In computing the capital positive factors tax you. Estate tax in the Philippines is 6 of the net estate. Capital gains presumed to be realized from the sale of a real property not categorized as ordinary asset is subject to a tax of six percent 6 based on the highest among the 1selling price 2Bureau of Internal Revenue BIR zonal value and 3assessed value by the provincialcity assessor.

According to the Philippine Tax Code Capital Gains Tax is a tax that is imposed on earnings that the seller has gained from the sale of capital assets. This is not necessarily the case. The Philippines is strategically located off the southeastern coast of mainland Asia with a flying time of four hours or less to most major Asian countries.

An individual is also subject to Capital Gains Tax on the sale of unlisted shares at a rate of 5 on net income not exceeding PHP 100000 and 10 on the excess. Average Title transfer service fee is 20000 for properties within Metro Manila and 30000 for properties. 15 of the net capital gains for unlisted shares of stock including shares of publicly listed companies that failed to comply with the minimum public ownership MPO requirement.

Capital gains taxes. The property is directly and jointly owned by husband and wife. They have owned it for 10 years.

The payment of the capital gains tax is dependent and is a direct consequence of the sale transfer or exchange. However a person has no records of availing of the tax exemption for the last decade. Gains from the sale are considered Philippine-source income and are thus taxable in the Philippines regardless of the place of sale.

If held for more than 12 months only 50 percent of the gain is subject to tax. Capital Gains Tax. D Capital Gains from Sale of Real Property.

The Withholding of Creditable Tax at Source or simply called Expanded Withholding Tax is a tax imposed and prescribed on the items of income payable to natural or juridical persons residing in the Philippines by a payor-corporationperson which shall be credited against the income tax liability of the taxpayer for the taxable year.

Buying Property In The Philippines Youtube

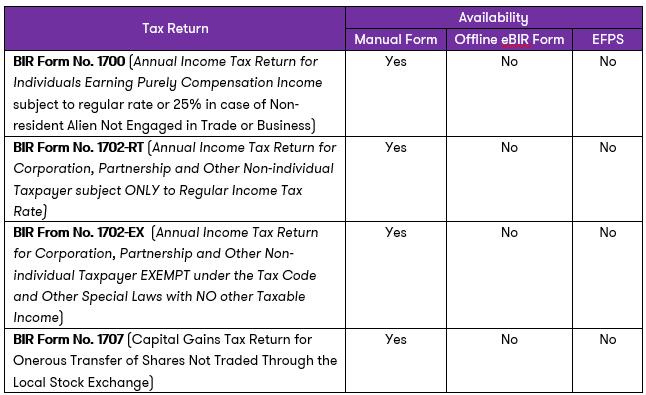

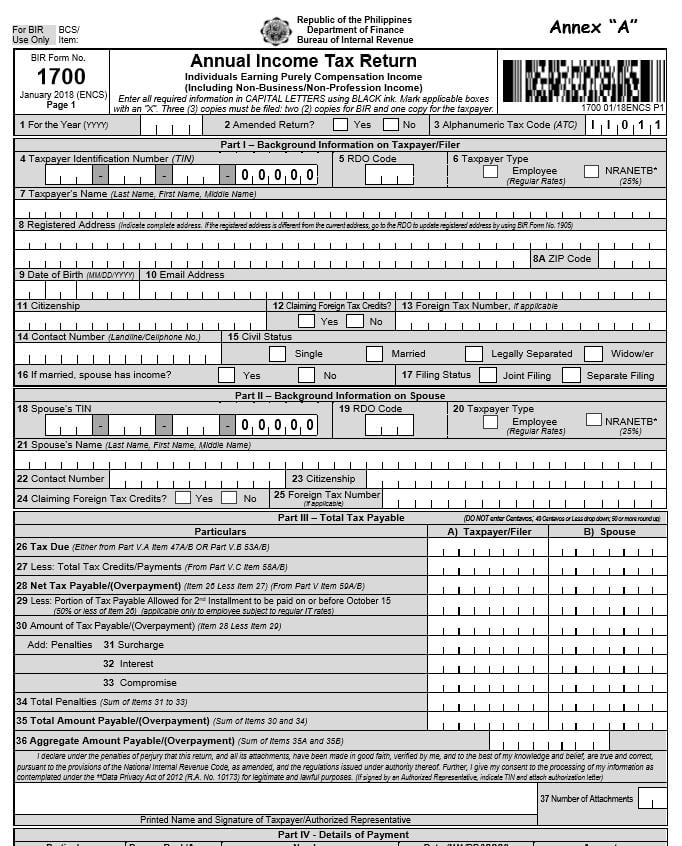

New Annual Income Tax And Capital Gains Tax Returns Grant Thornton

Train Series Part 4 Amendments To Withholding Tax Regulations Zico

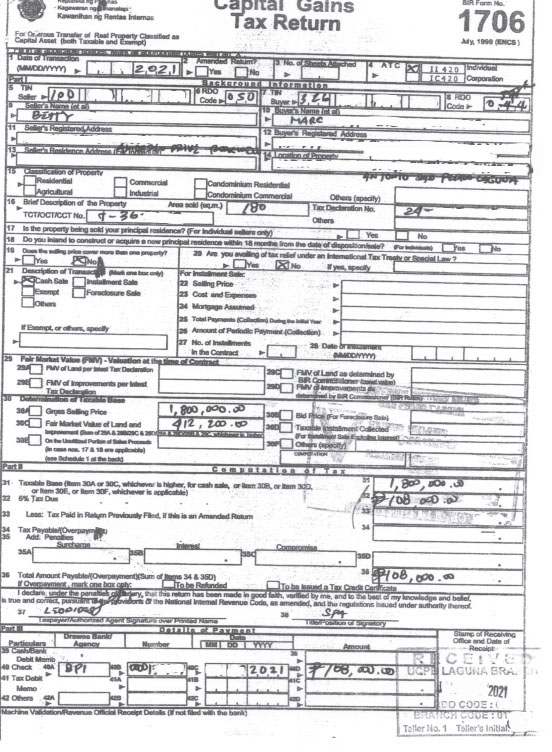

Capital Gains Tax Return Business Tips Philippines Business Owners And Entrepreneurs Guide

How To Compute Capital Gains Tax Train Law Youtube

Capital Gains Yield Cgy Formula Calculation Example And Guide

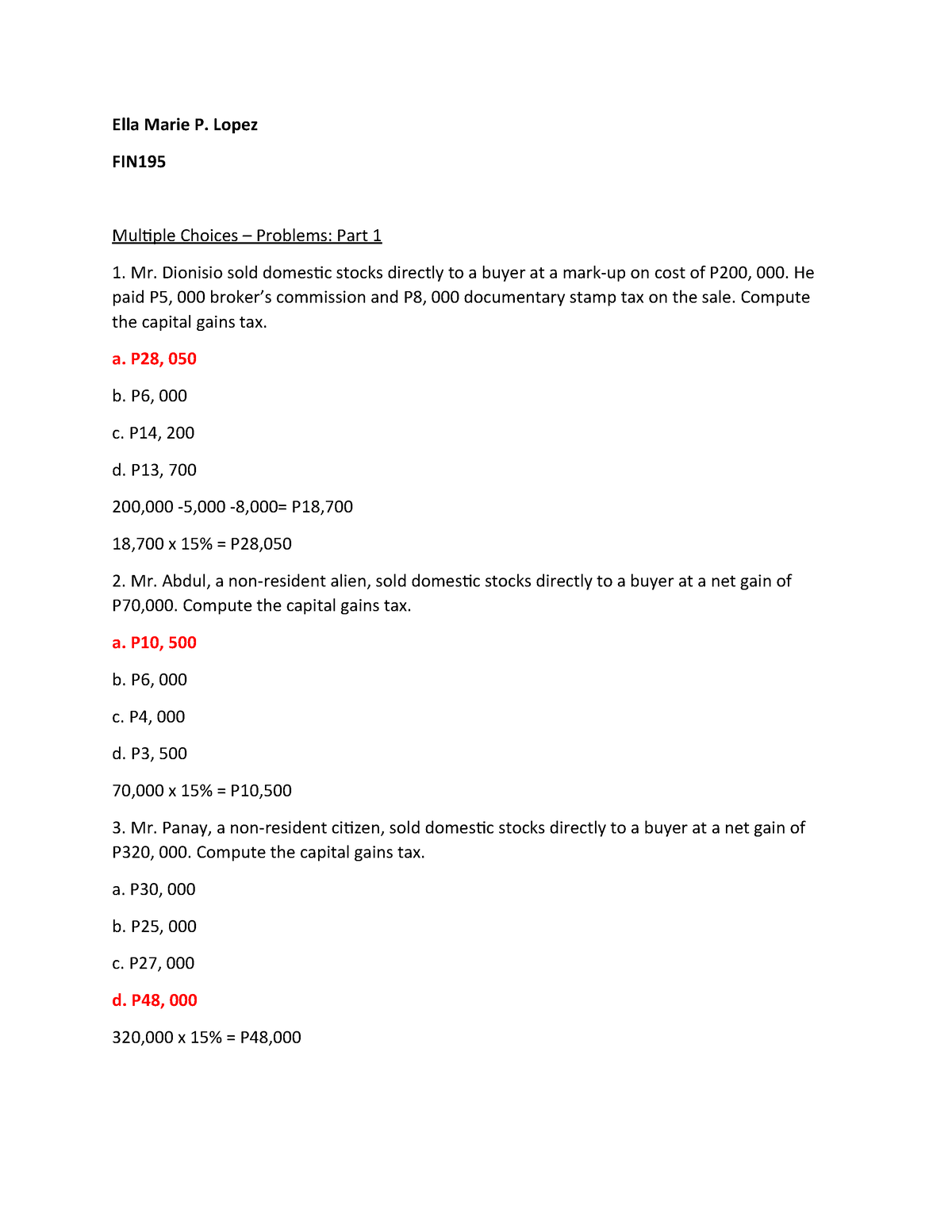

Capital Gains Tax Ella Marie P Lopez Fin Multiple Choices Problems Part 1 Mr Dionisio Sold Studocu

Capital Gains Tax How To Fill Up Bir Form 1706 Youtube

New Annual Income Tax And Capital Gains Tax Returns Grant Thornton

Income And Withholding Taxes Ppt Download

How To Compute File And Pay Capital Gains Tax In The Philippines An Ultimate Guide Filipiknow

Capital Gains On Selling Property In Orlando Fl

Capital Gains Tax Exemption Philippines With Sample Computations Youtube

Duterte S Economic Managers Not Concerned About Below Target Yield From Train Gma News Online

New Annual Income Tax And Capital Gains Tax Returns Grant Thornton

Taxes And Title Transfer Process Of Real Estate Properties This 2021